Table Of Content

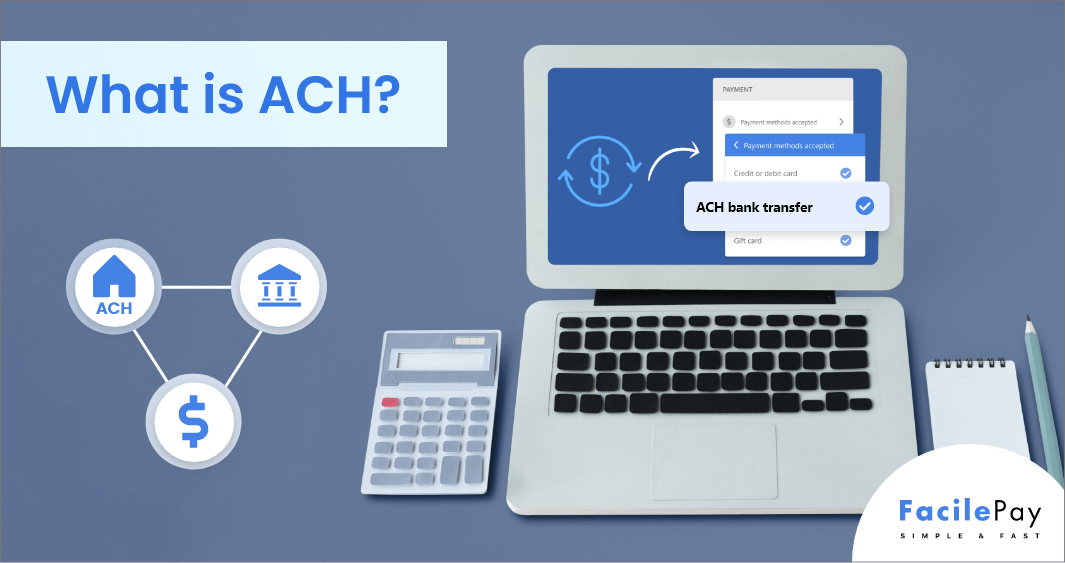

Whether it be to make sure your paycheck is in your bank in a timely fashion with direct deposit or to pay your recurring monthly bills, it’s all done with ACH. Although quicker than checks, ACH transfers can still take several days to process. ACH transfers make paying bills or receiving money less complicated and time-consuming than writing or mailing a check. That’s why, according to Nacha, tens of millions of Americans use the ACH network — in 2021, the ACH Network processed more than 29 billion payments. With ACH direct deposit, electronic payments are made directly into your bank account, whether it's a checking, savings or high-yield savings account. Also known as Direct Deposit, Direct Payment, direct debit, electronic funds transfer (EFT), or an electronic check (eCheck), ACH transfers are a quick and easy way to make or receive payments.

What is an ACH vs. wire transfer?

Larger-dollar, lower-volume same-day payments are usually routed through the same-day transfer systems, such as Fedwire and The Clearing House for Interbank Payment System (CHIPS). In the U.S., access to clearing and settlement systems is typically limited to financial institutions only. No matter the type of business you run, accepting ACH payments from customers broadens your horizons. To do this, you’ll need to sign up with a payment processing company like PaySimple, Plaid, or Stripe. They will provide all the necessary tools that business owners need to accept electronic funds transfers. Check with your provider and see if they have ACH processing capabilities.

Potential downsides to ACH Transfers

Aside from being easy to use, another huge advantage of these apps is the speed they can provide for transfers. You may be able to complete the transfer of money in just a snap, depending on which apps you use. These employees usually have access to the accounts of the customers and may illegally obtain protected terminals, files, or data and use them to misappropriate funds.

Benefits of ACH payments for businesses

We need just a bit more info from you to direct your question to the right person. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Same way applies to unlocking the data so that anyone with key access can decipher the ciphered text. Fraud risks can happen when employees of ACH operators change or alter customer account data and embezzle funds.

The recipient, on the other hand, will see the transaction as an ACH credit. The recipient of the direct deposit will see an ACH credit reflected on their account for these transactions. An ACH transfer is the electronic movement of money between banks through the Automated Clearing House network. Many banks impose limits on how much money you can send via an ACH transfer. There may be per-transaction limits, daily limits, and monthly or weekly limits. A People’s Choice can help you prepare the necessary real property deeds along with the required preliminary change of ownership forms.

Since reconciling your account(s) daily is advisable but may not always be possible, Citi recommends that clients implement an ACH debit block on their U.S. Although the majority of ACH transactions are legitimate, an ACH debit block can help reduce the potential for unauthorized, fraudulent and/or erroneous ACH debits. Citi's ACH Warehouse Inquiry feature enables users to query Citi's ACH database for ACH transactions. This feature provides access to additional transaction information including remittance details. Citi's enhanced web-based solution was specifically designed to provide you with the tools and information you need — when you need it.

Whereas ACH transfers may take days, domestic wire transfers may be completed in minutes or hours. Upon transfer of real property in California, the government imposes a documentary transfer tax on each recorded document in which real property is sold. Documentary transfer tax is like a “sales tax” due at time of transfer of real property in California. California law provides a variety of ways to transfer real property with property deeds. Since there are several different types of property deeds in California, it’s important to understand the purpose and effect of each type.

And because ACH payments go directly from one bank account to another, and most banks give you the ability to set up recurring payments, this payment method is an easy choice for automating many recurring business expenses. SecurityNacha has strict security regulations for any institution or organization involved with ACH transactions. This includes banks, businesses, and third-party processors who work with ACH payments. Among Nacha’s rules is a requirement that all sensitive information (e.g., bank account numbers) needs to be encrypted. Some payment processing providers, like Stripe, offer additional services related to ACH payments, such as the option to use microdeposits.

What Does ACH Stand For? - Bankrate.com

What Does ACH Stand For?.

Posted: Tue, 18 Jul 2023 07:00:00 GMT [source]

The ACH network is most commonly used for bill payments, sending money to friends, transferring money between your accounts, receiving direct deposits for your paycheck, government benefits, or tax refund. Banks, credit unions and employers don’t charge their clients to receive direct deposit. The cost of processing an ACH transfer will depend on the bank and type of transfer — your bank may charge you a fee (usually a few dollars) to move money from your checking account to an account at a different bank. Direct payment refers to the movement of money to make or receive payments.

These apps enable you to send money to people using their email addresses or phone numbers. This involves verifying the identity of the receiver of the ACH transaction in congruence with account verification. This might happen when a company suffers large financial losses, like bankruptcy. Even with the ACH network in place, there are certain risks that come along with it. Businesses should be aware of these before using the ACH for their transactions. This means that you give them your payment details, such as account and routing number.

Remittance transfers or international wires sent through a remittance transfer provider have special consumer protections, including the right to cancel within 30 minutes and the right to resolve mistakes. ACH may also be known as or referred to as direct deposit, direct debit, check, EFT, and electronic bank transfer. How ACH transfers work can depend on whether the transaction involves a direct payment or a debit.

An Automated Clearing House (ACH) is a network that processes electronic payments and transfers across the United States. ACH payments can be made online through your bank’s or credit union’s website or mobile app. Sometimes you can pay a bill by ACH transfer; you’ll need to provide the merchant (on its website or in its app) with your bank’s routing number and your account number to do this. Person-to-person payments that you initiate through your bank or third-party apps such as PayPal can cost a small fee, depending on the platform and payment method. NACHA rules ensure that banks can process payments the same day they’re sent, but it’s up to each bank whether it charges you for expediting a payment.

The costs for ACH transactions ensure funds are securely transferred. However, ACH transfers will always remain one of the most affordable options available for sending money quickly. Per guidelines by NACHA, ACH debit transactions must be processed by the next business day. ACH direct deposits are ACH transfers for putting money into an account. According to NACHA, 96% of employees are paid through direct deposit.

He also writes for The Ascent (a Motley Fool service), where he covers insurance, credit cards, personal finance and investing. Ben has over 10 years of experience as a freelance content writer for regional banks, tech startups, and financial services companies like LendingTree and Prudential. He also works as a ghostwriter for business executives, with bylines in publications such as Fast Company, Entrepreneur and TechCrunch. ACH transaction fees often charge $3 on average for standard delivery and between $6-$10 for next-day delivery. Other banks will waive this fee if you send it online or sign up for automatic bill payments. ACH transfers differ from wire transfers, a type of bank transfer that’s usually faster and more expensive.

The originating financial institution submits ACH payments in batches each day. There’s a cutoff time, and if you miss that, the payment isn’t processed until the next business day. Easy bookkeepingPaying for business expenses via ACH transfer can streamline your business bookkeeping. You’ll have to reconcile payments issued from every source—bank accounts, credit cards, etc.—and reconciliation will be easier if you consolidate payments to initiate from your primary business bank account.

And if it does charge a fee, it may be a nominal cost of just a few dollars. ACH transfers have many uses and can be more cost-efficient and user-friendly than writing checks or paying with a credit or debit card. You can also use an ACH transfer to make single or recurring deposits into an individual retirement account (IRA), a taxable brokerage account, or a college savings account. Business owners can use an ACH transfer to pay vendors or receive payments from clients and customers. Currently, most counties charge $1.10 per $1000 value of transferred real property in California.

No comments:

Post a Comment